When something breaks down or fails, our natural response is to replace it with something else that does the same job. If your dishwasher packed up, you’d buy a new one; you wouldn’t look for one machine that washed dishes and another that dried them. But that’s what needs to happen with the third-party cookie.

The end of the third-party cookies will hit targeting, retargeting, frequency capping, measurement, attribution and campaign optimisation, among other aspects of online advertising. That’s why last year half the online advertising industry told IAB Europe it was “critically important” to find a replacement. And it’s why this year has seen brands embrace the idea that first-party data is the key to building a meaningful (and profitable) relationship with their customers.

But first-party is not the only data.

First-party challenges

Collecting and using first-party data is more problematic for some brands than others. It’s particularly challenging for those that sell through retailers or other middlemen, and so have no direct customer contact that allows them to collect it. But even in those sectors that sell direct, brands still need to increase the amount of data they hold, bring it together, and enrich it in order to understand their customers better.

It’s also most critical at the acquisition stage of the customer journey. In a privacy-first world, how can you start relationships with new prospects if you have little or no first-party data about your existing customers to build on?

This is where it’s crucial to have a 360º data strategy, to understand what other data you can access, inside your organisation and outside. For example, if you’ve created customer personas, you’ll have the opted-in research data that informed the process. You can use this to find common attributes across the population to acquire the right type of customers.

Or you can look for in-market signals from aggregated datasets, such as Mastercard or IRI, or partner with retailers to use person level aggregated shopper data. These can tell you who’s buying in your category and from your competitors. What’s more, retailers are increasingly realising that data partnerships that help brands understand their customers better will also increase sales in-store. In a recent session at The Drum’s Digital Summit, Does the future belong to the data-rich?, our own Hugh Stevens talked about French retail giant Carrefour’s recently-announced programme that aims to do just that globally.

Starting a relationship

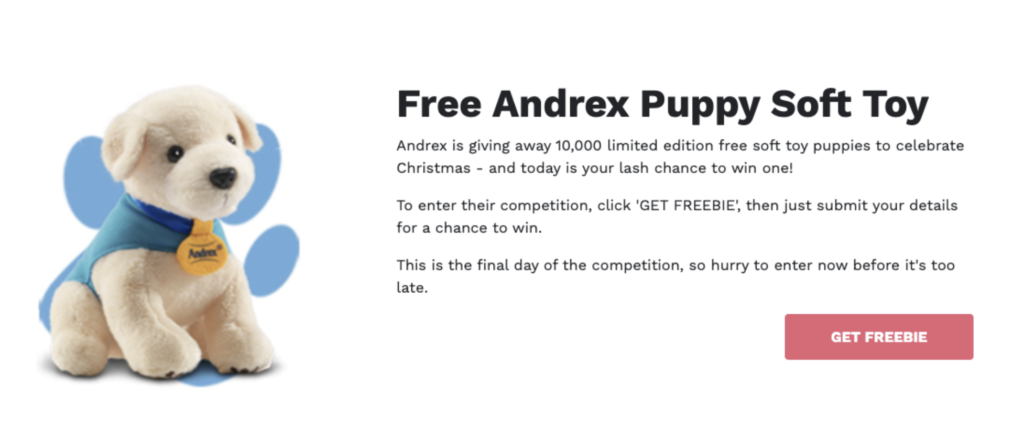

At this point there are a host of well-tried mechanisms to start building relationships with potential customers, such as competitions and sampling. Some marketers argue that this doesn’t work because they’re in low-interest sectors. But toilet paper brand Andrex very successfully leverages a key brand asset – the Andrex puppy – in competitions to win a soft toy.

One of our clients, food & beverage company Danone, wanted to strengthen its consumer intelligence to sharpen its media strategy and boost ROI. But it didn’t have the data to reach large numbers of consumers directly. It worked with retail partners, data marketing experts Numberly, and LiveRamp, to build a campaign strategy that optimised and augmented its audience segmentation. It also increased the addressability of its audience, improved online sales and allowed the brand to own its data and build direct relationships with consumers.

From here on, data begets data. You can use what you learn about your newly acquired customers for lookalike modelling, as well as to validate and enrich your view of the customer with personas, demographics and in-market buying signals.

Then, as you move into the engagement phase of the consumer journey, messaging becomes more personalised. Every time you contact a customer you should aim to learn a little more about them to enrich your customer view; something we’ll look at in more detail in our next post.